-

Might have a New Fed Chair Announcement next week. or the week after, or the week after.

OMG you would NOT believe what happened… I’ll tell you next week.

That is exactly the vibe coming out of the White House right now.

New Fed Chair announcement coming next week we hope.

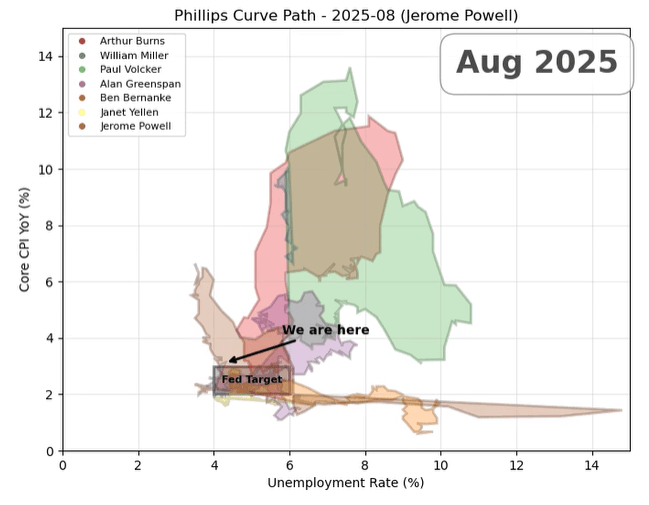

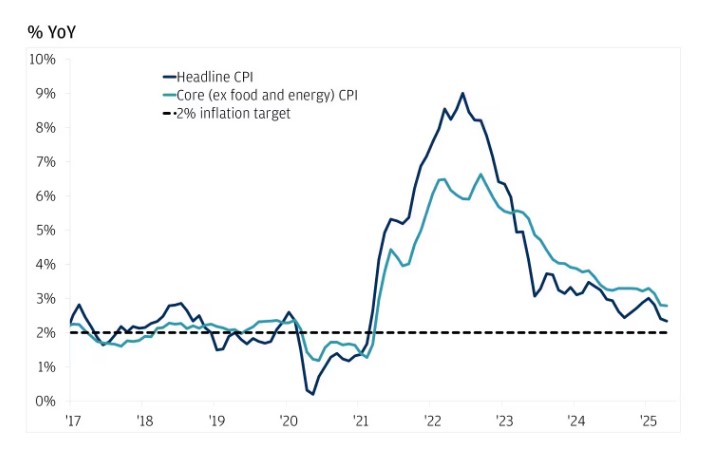

Rate cut this month? Maybe. Maybe not. Inflation is behaving, the job market seems… fine-ish, but as always, perception is doing most of the heavy lifting.The timing of teasing a new Fed Chair while Powell is also hinting at possible rate cuts next week has not gone unnoticed. Feels a lot like, “Big news coming… but let’s circle back.”

The NAR Realtor Confidence Index show more confident first quarter 2026 than in 2025. This is true for most or our industry. we are gearing up for the turn around that has already started.

Start by getting pre-approved. http://www.YourApplicationOnline.com

This is a great image of the struggle the Feds over time have been facing regarding Fed Target inflation rate and the Fed rate. Click it has a hyperlink showing progression over time.

-

Inflation is Stalling and Slipping, Fed let’s Get to Getting.

The President backed off tariff threats toward the EU, and Greenland is effectively off the table. That reduction in geopolitical noise matters, uncertainty and instability hurt everyone, particularly stocks and bonds.

On the data front, Q3 GDP growth came in stronger than prior estimates at 4.3%, reinforcing the case that the economy can withstand rate cuts without reigniting inflation. Jobless claims remain stable at 200,000, while continuing claims fell by 26,000, signaling ongoing labor market resilience.

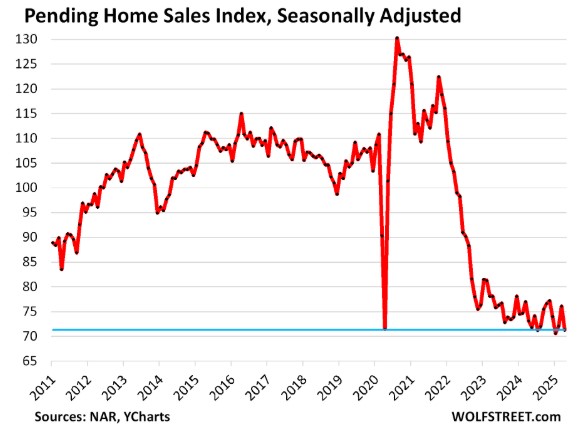

The outlier was Pending Home Sales, which declined 9.3% in December and are now down 3% year over year. That said, we expect this to turn in Q1, as early indicators show buyer activity picking up alongside improved rate stability.

Rates continue to fluctuate, but within a relatively tight range. All in all, the backdrop is constructive, let’s get 2026 rolling.

Online Application http://www.YourApplicationOnline.com

-

Why Refinance your 6.5% rate to 5.875%. Because you will save $72,954.

Current Loan

6.50% | 30-Year

- Monthly P&I: $3,160

- Total interest: $637,722

Refinance at 5.875%

30-Year

- Monthly P&I: $2,958

- Total interest: $564,768

- Interest saved: $72,954

- Cash-flow improvement of ≈ $202/month

20-Year

- Monthly P&I: $3,546

- Total interest: $351,086

- Interest saved: $286,636

- Much faster equity buildup with a moderate payment increase

15-Year

- Monthly P&I: $4,186

- Total interest: $253,407

- Interest saved: $384,315

- Maximum long-term savings, fastest payoff

Takeaway

- 30Y: Best for monthly savings

- 20Y: Strong balance of payment + wealth building

- 15Y: Massive interest savings if cash flow allows

Soft Credit pull, let’s find out. http://www.YourApplicationOnline.com

-

Why Stocks and Bonds Fell Together: When the “Safe Haven” Isn’t Safe

Risk-on assets are those favored when investors are optimistic about economic growth and willing to take on greater risk in pursuit of higher returns.

These typically include equities, commodities, high-yield (junk) bonds, real estate, and certain higher-beta currencies.

Conversely, when investors perceive rising uncertainty or economic stress, capital usually flows into traditionally safer assets such as bonds.

In the current environment, however, U.S. Treasuries are being viewed with more caution than usual, as tariff threats and broader global instability have introduced an added layer of risk to what is normally considered a safe haven.

Rates moved slightly higher today but not as bad as I anticipated.

Let’s get you qualified http://www.YourApplicationOnline.com

-

Lower rates and boy what a difference in home sales. Get Ready and get Pre-Qualified

Yesterday’s New Home Sales data was released, which measures signed contracts on new construction. We’re seeing a 19% year-over-year increase, running at an annualized pace of 737,000 homes, the highest level in three years.

This morning, Existing Home Sales were released and significantly exceeded expectations. Forecasts called for a 2% increase, but the actual number came in at 5.1%.

When rates move lower, buyers pay attention. They also pay attention to home values and in some regions, more favorable pricing. Eventually, that combination creates a tipping point where buyers decide to act.

We may be approaching that moment.

As always, I’ll continue to monitor the data and keep you updated as conditions evolve.

Pre-Qualification Soft Credit http://www.YourApplicationOnline.com

-

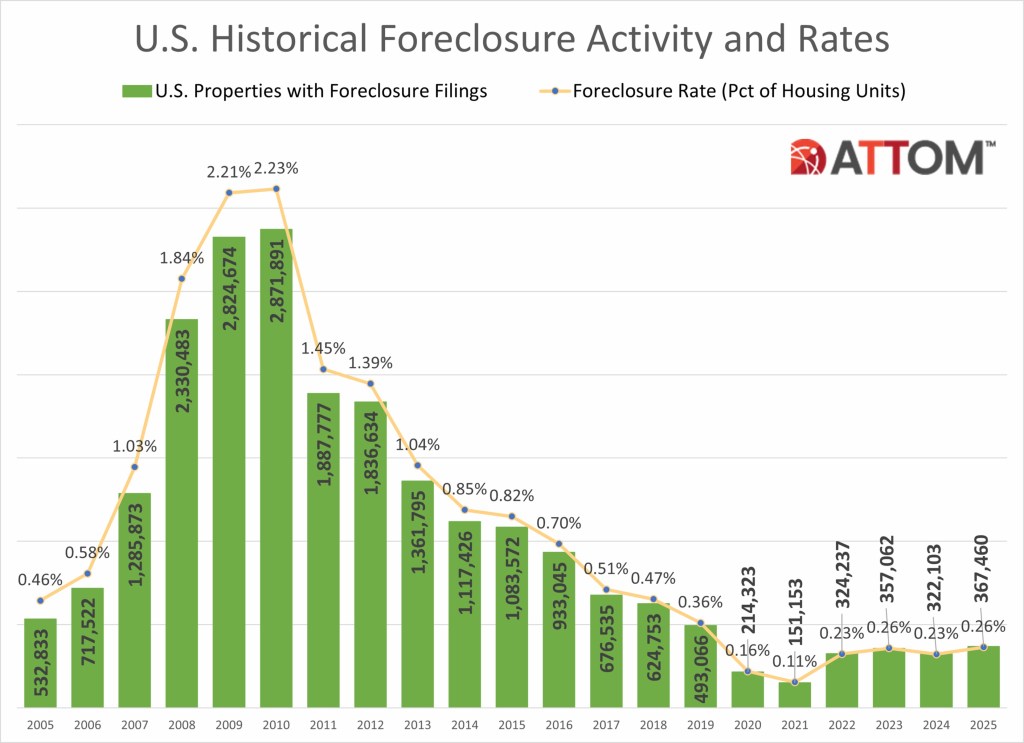

OMG Foreclosures up 14% What’s going on.. Click Bate.

Nothing is quite what it seems.

ATTOM Data Solutions released data showing foreclosures are up 14%. At first glance, that sounds alarming and sparks fears of another housing crisis—but that’s not the full story.

Yes, foreclosures increased 14%, but they rose from an extremely low base of just 0.26%. That’s roughly one-tenth of the foreclosure rates seen during 2009–2010.

At the same time, housing starts are up both new and existing homes. Rates have remained relatively low and appear on track to stabilize and potentially decline further into 2026. Inflation continues to cool and may reach the Fed’s 2% target sooner than many expect.

The data doesn’t point to a housing crisis, it points to normalization.

Get ready for the new year http://www.YourApplicationOnline.com

-

The Bond Market is like a bowl of Candy, the more you have the less valuable each piece is.

Using this analogy, it’s easier to understand why the bond market barely reacted to last week’s rate-friendly data and the global turmoil, especially with Iran.

The key reason: federal prosecutors opening a criminal investigation into Fed Chair Jerome Powell.

U.S. bonds are considered the safest place in the world largely because the Federal Reserve is independent from the President. That independence is a critical guardrail.

When that independence is questioned, global bond managers get nervous. China has already sold billions in U.S. bonds, and other countries are either doing the same or considering it.

Think of bonds like candy in a jar.

Less candy means each piece is more valuable, so yields (rates) go up. To get people to buy bonds, you have to offer better pricing. If demand is high, no incentive is needed. That’s why Quantitative Easing pushes rates lower: more government “candy” in the jar.

When prosecutors went after Powell, that independence came into question. As a result, fewer global buyers stepped in and some sold what they already owned. That selling pressure offset the flight-to-safety gains we normally would have seen in bonds.

Bipartisan pressure is building, including from Treasury Secretary Scott Bessent.

Cooler heads will prevail and this investigation will go away.

‘Let’s get you pre-qualified as we see rates dropping over the next 6 months and you want to be ready. http://www.YourApplicationOnline.com

below 10y US Treasury. Up is lower rates, down is higher rates.

-

Fed Subpoenaed, Venezuela takeover, Iran unrest, Cuba, Greenland. But no flight to safety. Why

From my viewpoint, this is one of the biggest head-scratchers right now.

Federal prosecutors going after the Federal Reserve, specifically Chair Powell, adds yet another layer of uncertainty. At the same time, the current President wants Powell out before his term expires in May.

Add in the broader global turmoil: Venezuela, unrest in Iran, Cuba, and even Greenland. Under normal circumstances, this would have triggered a clear flight to safety.

Instead, I woke up to yawns from the bond market.

Is this complacency? It’s hard to say.

Tomorrow’s Consumer Price Index (CPI) for December is critical. Expectations are for year-over-year inflation to remain unchanged or possibly decline slightly. That outcome would be bond-friendly and supportive of lower rates.

On the housing front, Realtor.com released new data showing inventory is up 12%. That’s encouraging news, especially as rates begin to move lower in a more meaningful way.

More supply, combined with easing rates, could finally start to bring some balance back to the housing market.

Let’s get you pre-qualified today http://www.YourApplicationOnline.com

-

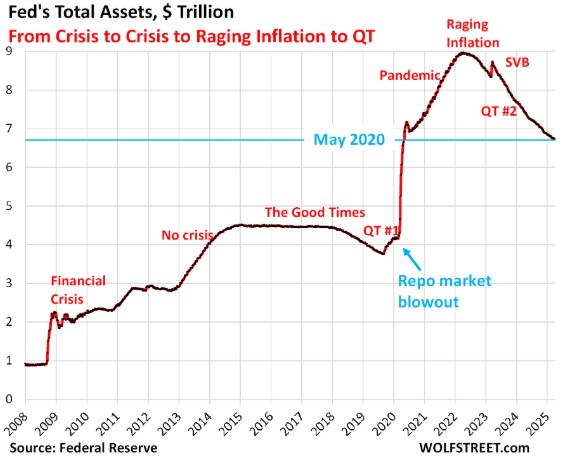

QE is back Baby and the Mortgage Rates are loving it. Get your affairs in order and start that refinance now.

The President instructed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities. This is effectively Quantitative Easing (QE), the purchase of bonds to add liquidity and support lower interest rates.

For the past five years, we have been in Quantitative Tightening (QT), where the Fed has been reducing its balance sheet by selling Treasuries and MBS. That prolonged selling pressure has pushed bond yields higher and, as a result, negatively impacted mortgage rates.

A shift away from QT toward QE is meaningful for housing and could provide much-needed relief for rates.

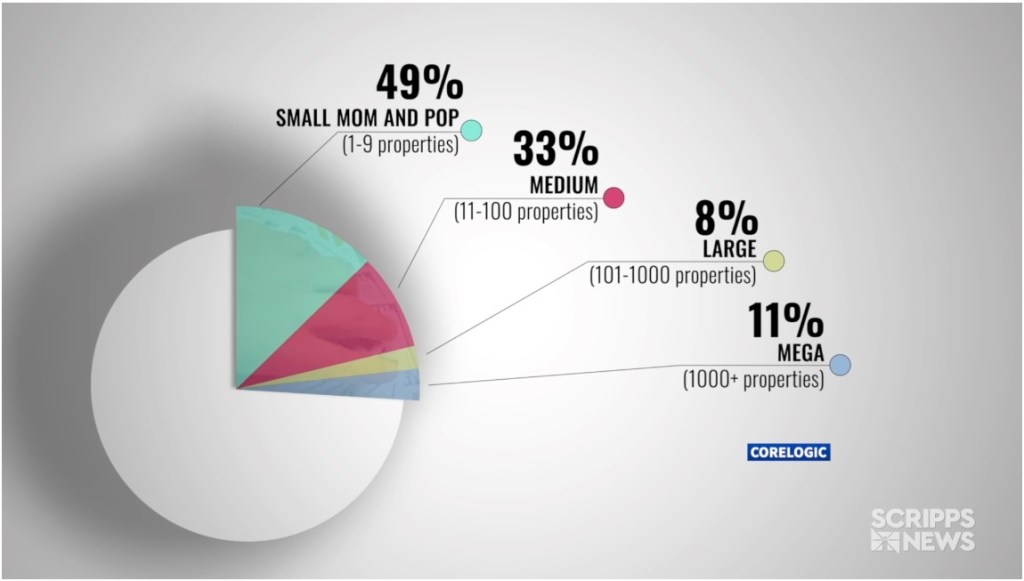

The President also strongly suggested curbing large institutional investors from purchasing single-family homes. The intent is to prevent big corporations from “gobbling up” housing inventory and instead prioritize owner-occupants and very small investors.

Limiting bulk purchases by large funds could help stabilize home prices, increase available inventory, and improve affordability for individual buyers, especially first-time and move-up homeowners.

This isn’t a new concept. Variations of this proposal have been discussed for years, including by lawmakers on the other side of the aisle, particularly as institutional ownership of single-family homes has grown.

Time to get pre-qualified for a purchase or refinance http://www.YourApplicationOnline.com

-

A single Tweet took the Bond market from Rate to not Rate friendly.

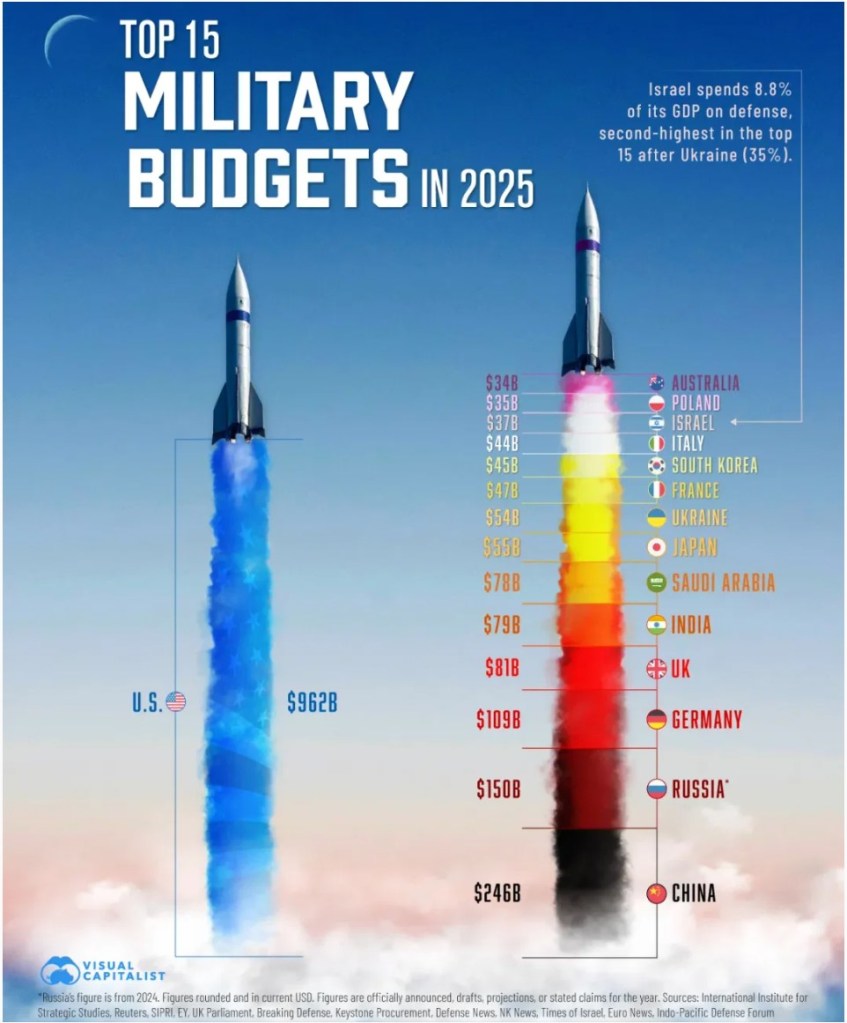

Increasing the defense budget to $1.5 trillion, yes, trillion, represents roughly a 50% increase. The obvious question is: where does that money come from? It gets printed, and that’s exactly what rattled the bond market.

The gains we were expecting from productivity and jobless claims were erased with a single tweet.

Tomorrow’s BLS Jobs Report is expected to show the unemployment rate edging down from 4.56% to 4.50%. On the surface, that seems insignificant, but these figures are rounded.

- 4.56% prints as 4.6%

- 4.50% prints as 4.5%

That rounding can change the narrative.

Bottom line: you can’t rely on the headline number alone. You have to look under the hood to see what’s really going on.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.